AETOS Review

Table of Contents

What is Aetos?

AETOS is a global provider of FX and CFDs that gives international traders access to many markets, including forex, metals, energy, and indices. While serving their clients through corporate headquarter in Sydney, Australia and serving global presence through London, UK office, and customer support office in China.

The Aetos broker is trusted and respected in these critical financial cities. AETOS Capital Group is one of Australia’s most prominent non-banking financial institutions, which provides clients from over 100 countries with service and trading environments.

Aetos Pros and Cons Aetos is a well-regulated company with easy account opening, a good range of funding methods and a professional trading environment.

Yet, the company does not provide the learning material considered a gap for the beginning traders.

However, the free technical analysis covering all markets from leading investment research providers is the cornerstone of good trading strategies.

Is Aetos safe or a scam – AETOS Review

No, Aetos is not a scam since regulated by top-tier ASIC providing low-risk Forex and CFD trading.

AETOS Capital Group Pty. Ltd. is registered in Australia and is a wholly-owned subsidiary of AETOS Capital Group Holdings Ltd. In turn, AETOS Capital Group Pty. Ltd. is licensed and regulated by the Australian Securities and Investments Commission (ASIC). Read why trade with ASIC brokers by the link.

In addition, the United Kingdom entity AETOS Capital Group (UK) Limited is authorized and regulated by the respected authority FCA. Therefore, it means Aetos broker abides by their regulations and rules while the clients’ funds are safe in segregated accounts with central banks away from the company’s accounts.

Also, Clients are eligible for claims through the Financial Services Compensation Scheme (FSCS), which covers business conducted by firms authorized by the FCA.

Leverage

Leverage is a pretty known instrument, which multiplies the initial capital you trade and can be a handy tool to magnify your potential gains, but in case you use it smartly. However, always note that high Leverage can work in reverse too.

Aetos is a regulated broker in two major jurisdictions that complies with slightly different trading conditions according to particular regulatory obligations. Therefore, Australian clients trading with AU Aetos are entitled to enjoy high Leverage up to 1:400. However, those traders operated under the European FCA regulation can use limited Leverage with a maximum of 1:30 on Forex instruments.

AETOS Account types

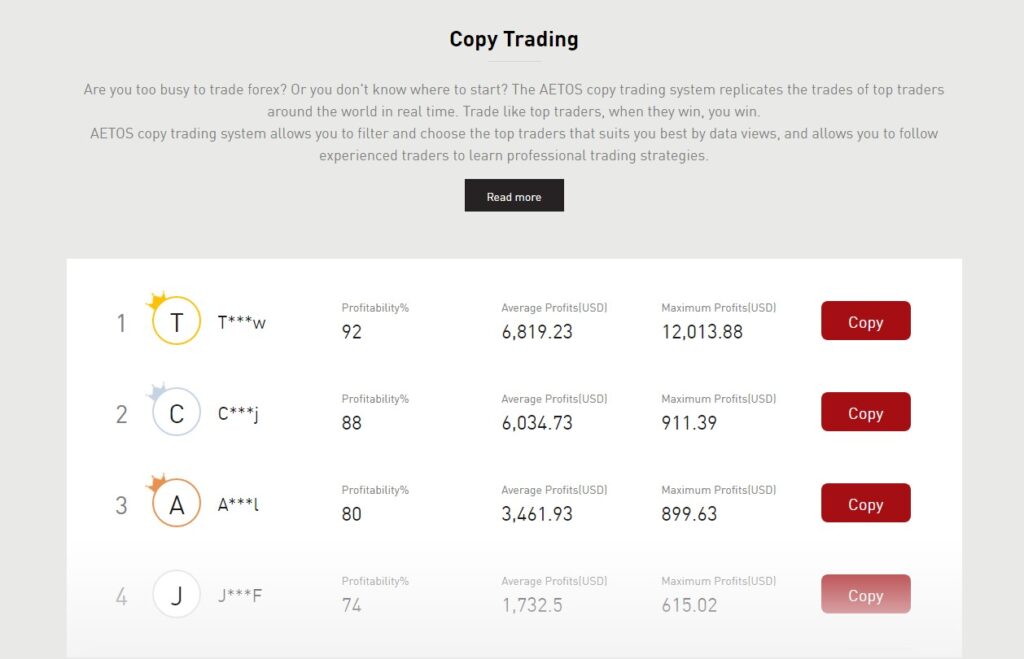

UK branch offers three different accounts: General Account, Premium Account, and Demo Account. The accounts feature the same technical productivity, and Expert Advisor (EA) feature enabled, allowing automated trading, copy trade, and other customization through own scripts written in MQL4 programming language.

The AU offers Professional Account, Institutional Account and Money Manager Accounts for qualifying established individuals or asset managers.

AETOS Review – Spreads

The general AETOS offering comes with quite competitive spreads for the range of products as we found by our research, e.g. the latest EUR/USD spread is 1.8 for professional accounts. AETOS diversify their features of different clients and meet their needs while including professional accounts, institutional with floating spreads, and numerous programs.

See typical costs below. Also, compare Aetos fees to another popular broker Pepperstone.

Fees

AETOS Review – Deposits and Withdrawals

So once you are ready for live trading, you’ll be able to deposit or after withdraw funds via wire transfers, debit card, or other payment platforms, including Skrill and ZotaPay.

Minimum deposit

Aetos minimum deposit amount is 250$, which is excellent for many reasons. The Premium Account requirement is 20,000$, which features preferential spreads and tailored solutions for high volume traders. Yet, make sure you read carefully about the necessary margins on a trading instrument you choose to trade.

AETOS Review -Trading Platforms

AETOS provides an advanced and efficient trading platform, MetaTrader4, for their trading and proposes using its latest version, MetaTrader5.

The choice of AETOS to use Metatrader4 and MT5 is logical since the platforms are among the most advanced and efficient trading platforms worldwide, that provides a wide range of indicators and the ability to combine skills or analyze the market efficiently.

Apart from the powerful functions, it’s also enhanced by various tools. At the same time, the company’s technology team developed a wide range of essential tasks on its MT4 platform and website, along with mobile platforms, MT4 plug-ins, and API development.

AETOS Review -Research

Since good research is the most valuable trading tool, Aetos also provides multiple ways to enhance the receiving data. Hence, the platform features Trading Central, a leading investment research provider aimed at financial market professionals, Trading Charts with the constant update to stay clearly regarding trading decisions, along with Market and Video Commentaries.

AETOS Review -Customer Support

Furthermore, the broker provides the expertise, training and needed support that enhances your trading capabilities. However, keep in mind that since two foremost world authorities regulate the company, the offers may vary according to the region and your particular residence.

Methodology for Forex Broker Reviews

Our forex broker reviews are conducted with a comprehensive, transparent methodology designed to give traders the information they need to make informed decisions. Here’s how we do it:

- Platform and Technology: We evaluate the trading platform for ease of use, reliability, and the availability of essential tools and features that support effective trading strategies.

- Asset Range: We assess the variety of trading instruments, including currency pairs, commodities, and indices, to ensure traders have ample opportunities.

- Fees and Spreads: We examine the broker’s fee structure, including spreads, commissions, and hidden charges, to gauge the cost-effectiveness of trading with them.

- Regulation and Security: We verify the broker’s regulatory compliance and the measures they take to protect client funds and personal information, underscoring their trustworthiness.

- Customer Support: We test the support team’s responsiveness, availability, and expertise to ensure traders can get assistance when needed.

- Educational Resources: We explore the availability and quality of educational materials and resources to support traders at all experience levels.

- User Reviews and Community Feedback: We consider feedback from the trading community and existing users to provide a well-rounded view of the broker’s performance and reputation.

This systematic approach ensures our reviews are thorough, unbiased, and reliable, helping traders navigate the complex world of forex trading confidently.

Justine Glover

About the Author

Justine Glover is a seasoned financial analyst and forex trader with over a decade of experience in the financial markets. Holding a Master’s in Finance from the University of Chicago, Justine has worked with several leading brokerage firms, developing trading strategies and economic models. Her insights have been featured in major financial publications, including Forbes and Bloomberg.

She is now living in Gstaad, Switzerland.

Disclaimer: Risks of Trading

In our review of Capitalix, we have examined several different characteristics, and it is easy to see why it has become one of the better trading platforms on the market. With low fees and trading costs, it’s also easy for beginners to get started.>

However, you should still consider the risks with this type of broker. When you use a trading platform where you trade CFDs, there is always a risk of losing money, but the risk will be higher if you start using leverage.

Therefore, limit your trading to smaller lots and don’t go in with more capital than you can afford to lose. It’s also important not to overdo it with leverage, even though it sometimes feels tempting. The risk is that you always lose more than necessary.